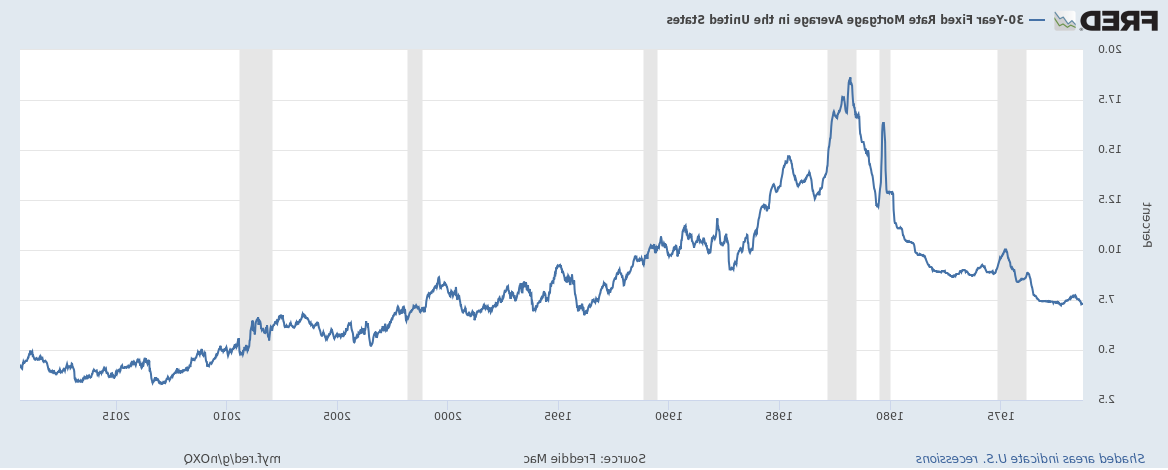

Rates for a 30-year fixed mortgage have hovered around 4% in the past week after hitting a 12-month high near 5% in November. While those tenths of a percentage point will matter to your clients’ monthly payments and how much they can afford, taking a step back can reveal just how inexpensive homebuying is right now.

Mortgage rates neared 19% in the early 1980s before dropping off by the ’90s and staying under 10% since 1991. During the run-up to the housing crisis, rates for a 30-year mortgage neared 7% before reaching post-crisis lows of 3.31% in 2012.

Homeowners who have taken out a mortgage in the past decade have been able to borrow at historically low interest rates. More than 80% of households with a mortgage pay between 3% and 5.9% in interest, according to the U.S. Census Bureau’s 2017 American Housing Survey. Nearly 95% of mortgage holders have fixed-payment mortgages.

Shopping around for the best rate will save your clients money, and they can use online tools like from the Consumer Financial Protection Bureau to examine how rates will impact their monthly payments. But week-to-week fluctuations in mortgage rates shouldn’t obscure how relatively inexpensive borrowing for a home is currently.

The rates we have today are lower in real terms than at any other time I can remember. What do I mean by “real terms?” Well, when interest rates were double-digit, so were real inflation rates as the 2 were joined at the hip. Today, we have inflation rates that are greater than reported (who does not agree with that statement?) but mortgage rates are probably almost in line or even a little lower than actual inflation. The way our government and others calculate inflation has changed dramatically which distorts the real rate of inflation. 25 years ago this was… Read more »